Be Ready for the Next Big Thing!

Fundraising Strategies to Implement Now

Elisabeth B. Galley and Dale C. Hedding, Vice Presidents

Special initiatives such as commissioning a new work, renovating a hall or museum gallery, or launching an endowment campaign are exciting opportunities that can only be achieved with careful planning and thoughtful preparation. However, much can be done well in advance of a major fundraising campaign launch – even before you know what that next big strategic initiative will be. In this issue of Arts Insights, we explore three practical steps your organization can take in the new year to position the board, executive leadership, and development team for maximum future fundraising success:

- Understand the value of wealth screening to identify potential major donors

- Develop customized cultivation plans for individual prospects, and

- Understand the role of the board nominating committee in campaign preparedness.

Special initiatives such as commissioning a new work, renovating a hall or museum gallery, or launching an endowment campaign are exciting opportunities that can only be achieved with careful planning and thoughtful preparation. However, much can be done well in advance of a major fundraising campaign launch – even before you know what that next big strategic initiative will be. In this issue of Arts Insights, we explore three practical steps your organization can take in the new year to position the board, executive leadership, and development team for maximum future fundraising success:

- Understand the value of wealth screening to identify potential major donors

- Develop customized cultivation plans for individual prospects, and

- Understand the role of the board nominating committee in campaign preparedness.

The Value of Wealth Screening

Ideal donors are those who have both an affinity, both in connection and commitment, for the organization and the financial capacity to make a significant gift. But how do you get beyond the usual suspects – those families that are the giving pillars of your community? One solution is to look more deeply into your organization’s database. Performing arts organizations have subscribers and regular single ticket buyers. Museums have members and frequent attendees. These individuals are consumers of your artistic and cultural experience and have displayed interest by attending programs and continuing to purchase subscriptions or memberships year after year. They are primed and ready to be invited to support your organization in a deeper way. But how do you know who, when, and for how much to ask?

Decades ago, before internet research was part of everyday life, development professionals would gather the members of their development committee and engage in sessions focused on looking at lists of names and gathering subjective financial information about friends of committee members. While parts of this practice are still valuable, donor prospect research has come a long way since then. Today there are several companies that offer wealth screening services for nonprofits, including Donorscape, Wealth Engine, Target Analytics, and iWave, among others. Although the specific information delivered may vary from company to company, the process is essentially the same.

Services provided by these companies help organizations electronically screen a large quantity of selected donor, subscriber, member, single ticket, or other individual records against some of the most respected public information databases. When data is matched, the resulting information may report on the prospective donor’s financial position, community connections, board experience, property ownership, age, public and private company ownership, and political contributions, among other data points. It also rates the prospect’s propensity to give and affinity for your organization to achieve a balance of connection, commitment, and capacity. This information can be used to determine potential sources of new or increased contributed income from individuals in the form of annual, capital, endowment, and planned gifts.

The returned information rates donors from top prospects who have a strong affinity for your organization and significant capacity to give down to those prospects who may love your work but cannot make a major gift. Development teams can carefully and sensitively use this information to:

- Determine the overall funding capability of your organization’s database.

- Identify a hierarchy of potential major donor prospects to cultivate for higher level gifts.

- Create robust portfolios for each development professional based on the donor prospect hierarchy information, as well as targeted portfolios for the CEO and selected board leadership.

- Develop personalized cultivation strategies and a moves management pipeline to acquire new major donors.

- Understand donors who may not currently have major gift capacity but will remain core annual fund contributors, and then design appropriate relationship maintenance programs for those donors.

Using wealth screening services, you will be able to segment your donor database to understand where to invest fundraising resources to yield the best results, regardless of the size of your development department or board. The costs for this service have become much more affordable in recent years and the return on investment is tremendous. By acquiring just one new or increased major gift, this investment will pay for itself.

Developing Customized Cultivation Plans

Ultimately, not all donors are equal. Some have more capacity than others and are therefore your true major donor prospects. Others may love your organization and its work but do not have the ability to give large gifts. Some constituents in your database know your organization well while others may have a cursory knowledge through public messages or attendance at occasional events.

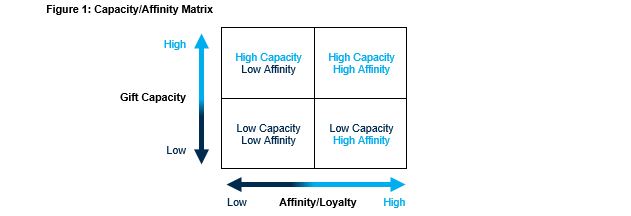

The matrix below (Figure 1) is a simple yet useful way to identify current donors who have the potential to become major donors. This matrix is an effective way to consider cultivation strategies with senior leadership, board members, and others who are in a position to assist in the fundraising effort.

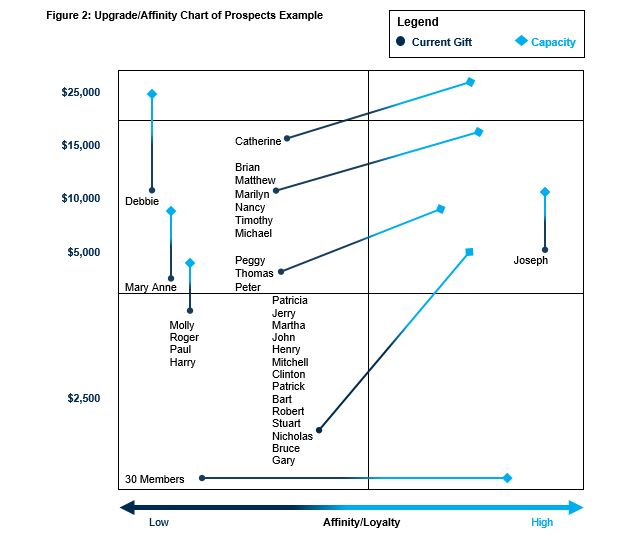

First, determine the capacity and affinity of individuals and families within your donor pool by using past donor history and anecdotal information regarding connection and commitment to the organization. In the example below (Figure 2), existing donors have been plotted in the Low Current Gift/Low Affinity quadrant showing the typical cluster of an entry-level giving group. Then, apply formal or informal wealth screening information to determine where donors could be – ideally, in a place where they are ready to make a major gift after increased knowledge of and deeper affinity with your organization. The goal is to leverage this information to strategically move prospects to the High Gift/High Affinity quadrant through increased cultivation. It is also important to recognize that some donors will stay where they are – either in the High Gift/Low Affinity quadrant because they contribute generously but your organization is not their top priority or in the Low Gift/Low Affinity quadrant because they have no further capacity.

The outcome of this exercise will highlight your top cluster of potential major donors and give you an idea of what needs to happen to move them from where they are today to a place where they are ready to make a major gift. Take the time to understand who each of these donors is and what they like – Bach and Beethoven or Philip Glass? Old Masters or Andy Warhol? Institutional support or program support? Youth education or creative aging? Make a concerted effort to get to know them through active participation at donor events, stopping by their subscribed seats, inviting them to lunch, and so on. Do not ask for money during these interactions but rather use this exchange to understand what they like about the organization, its programs, and its impacts. In other words, help them become more emotionally invested and involved.

Role of the Nominating Committee

Whenever an organization assesses its development operations or engages a firm to conduct a campaign feasibility study, the desire for more board members with both capacity and influence is often articulated. Visionary organizations will think about this long and hard before a major fundraising initiative is launched. The board, with influence from the development staff, is wise to consider board prospects and future leaders that can enhance organizational fundraising reach: corporate executives, potential major donors, and community leaders with spheres of influence are a few examples.

Again, valuable information can be gleaned from the wealth screening process. Identifying current patrons who have an affinity for the organization and a greater capacity than previously known are great candidates that the nominating committee could consider for board membership, as those candidates already know your organization well and can be inspirational ambassadors.

The nominating process should be a thoughtful and ongoing endeavor. Taking a longer view of the future needs of the organization, particularly around fundraising, will allow time for board prospect cultivation, which should increase the probability that a desirable candidate will be ready to say yes to your invitation. It also allows for a situation where “no, I cannot serve now” is the start of an ongoing dialogue that can develop into a “yes, I would be honored to join your board,” – hopefully, just when you need them to support and be an ambassador for your next big strategic initiative.