Building Data-Driven Individual Donor Prospecting

Strategies with Wealth Screening

Shawn D. Ingram, Vice President

As arts and culture organizations re-open their doors to audiences and members, the opportunity arises to meet in-person with existing donors and prospects to strengthen relationships that may have been nurtured virtually during the pandemic. Now that nonprofit leaders can reconnect with people, strategic and focused attention on individual donors at all levels is essential to reinvigorating donor investment in the future of arts and culture organizations.

The importance of individual giving cannot be overlooked. A pre-pandemic study by the National Philanthropic Trust noted that 69 percent of all philanthropic giving came from individuals.[1] A February 2021 forecast suggested that, with certain economic factors remaining stable, philanthropic giving by individuals in the United States is anticipated to increase by as much as 6 percent in 2021.[2] Additionally, many arts and culture organizations have attracted new audiences through virtual programming and thus have expanded their potential donor base. With individuals representing such a large percentage of giving, nonprofit leaders must make building, nurturing, and sustaining organizational investment by individual donors a priority. Identifying those with the affinity, capacity, and propensity to support an organization’s mission will be a critical element of success. This issue of Arts Insights offers six reasons why wealth screening services can help arts and culture fundraising teams incorporate strong, data-driven donor strategies and improve organizational performance to increase contributed revenue from a more diverse portfolio of donors.

What Is Wealth Screening?

Wealth screening services aggregate data from various fee-based, publicly available sources. Those databases flag specific information related to identified donors and connect the data points to assess their affinity, capacity, and propensity to give, defined as follows:

- Affinity: Connection to the cause

- Capacity: Ability to provide financial support

- Propensity: Philanthropic inclination

Wealth screening systems create a Prospect Score, representing a higher or lower level of affinity, capacity, and propensity related to the donor prospect. Wealth screening services also analyze individual giving history provided by the organization to assess the relationship between the prospect and the organization. The analysis addresses how recently, frequently, and at what monetary value an individual or household contributes and returns an RFM (recency, frequency, and monetary) score. Key data points might include:

- Charitable gifts of public record (philanthropic gifts not given anonymously)

- Board of director memberships

- Information from property records and tax assessments

- Political giving

- Potential identifiers of wealth, including those with stock holdings and private company ownership

- University and other social organization affiliations

- Data from sources such as Dun & Bradstreet, Thomson Reuters, and the Securities Exchange Commission.

Many screening services also return a gift range that traditionally represents the donor prospect’s entire estimated philanthropic capacity over a four- or five-year period. Understanding an organization’s potential support out of that total capacity gift range requires knowledge and perspective. In addition to validating the findings, a knowledgeable advisor with significant screening experience can support the interpretation of data and development of strategy to take full advantage of wealth screening results.

While wealth screening is often used in capital campaigns, it is also a powerful tool with day-to-day annual, planned giving, and endowment fundraising in organizations of any size. The use of wealth screening has a measurable impact on donor engagement strategies and organizational efficiency, as well as the equally important impact of empowering the development committee and staff team.

Six Reasons Wealth Screening Is a Catalyst for Increasing Contributed Revenue

1. Increase Efficiency

The most frequent use of wealth screening technology is the identification of high-net-worth individuals with affinity, capacity, and propensity. Given the percentage of contributed revenues derived from individuals, wealth screening provides an important foundation for fundraising in any arts and culture organization. Screening also offers the significant additional benefit of streamlining donor prospecting. While additional research must be conducted to confirm results, the high-level donor research is presented in prioritized and detailed formats. Donor research systems take out much of the donor prospecting guesswork and allow development leaders to more easily build targeted portfolios for the most experienced major gifts officers, executive directors, board members, and planned giving officers, as well as for junior development colleagues. Because of the way the data is presented, development leadership can start the process by sorting large units of data into various donor categories such as major gifts, planned gifts, endowment, and annual fund, which is often the most arduous task in portfolio creation and management. This time-saving step then allows for more focused review with specific development committee and staff members, building an efficient and targeted process that also builds investment in the portfolio.

2. Improve Portfolio Management

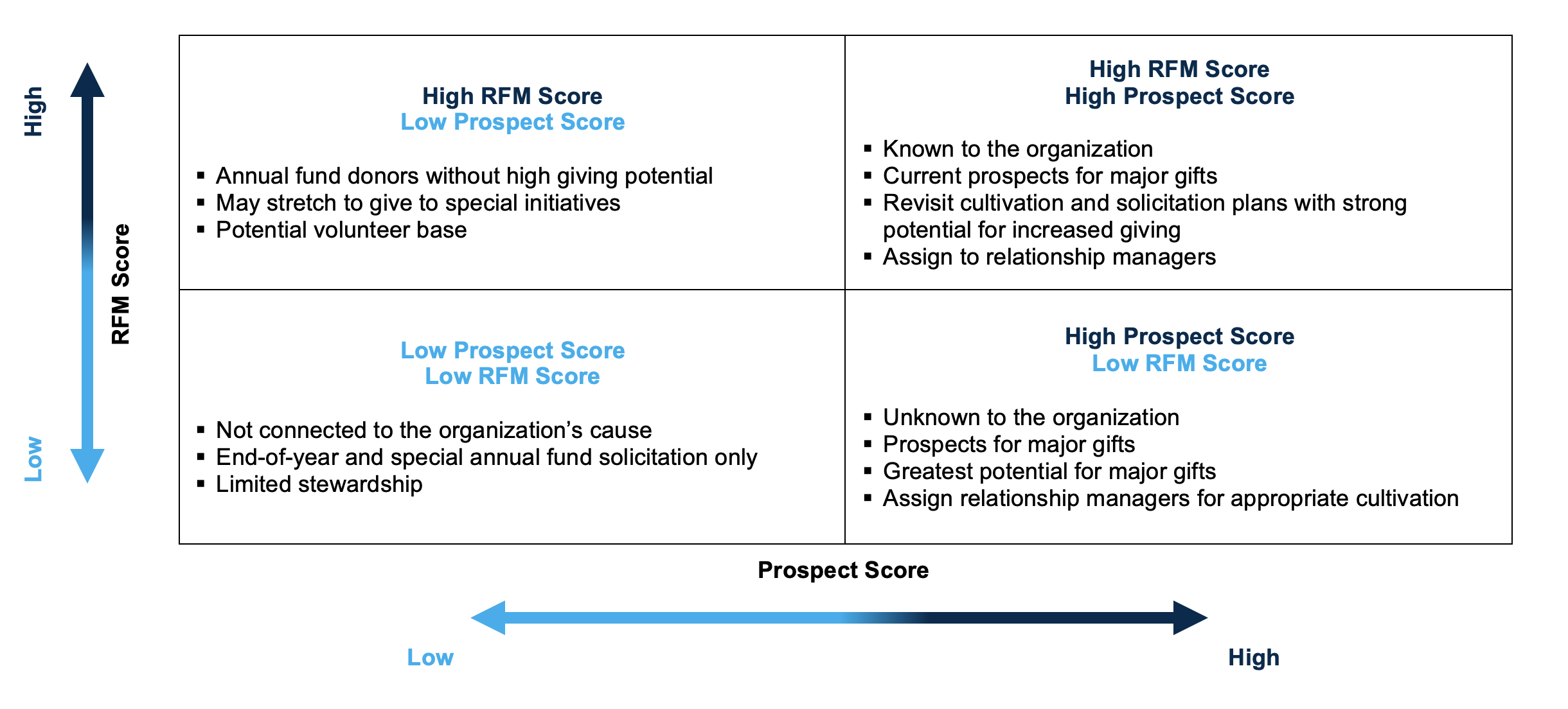

While it is easy to focus wealth screening attention entirely on major donors, the process also highlights opportunities to segment mid-range and lower-level donors to refresh and reorganize (or create) department and volunteer leadership portfolios. Portfolio management using wealth screening is especially effective for donor activity and engagement. While many donors are known to the development team, screening unlocks a myriad of potential new opportunities for segmentation and portfolio management. Using the Prospect Score and RFM Score noted previously, the Potential Prospect Segmentation graph below illustrates some common portfolio structures that arise as the result of wealth screening.

The lower right quadrant is often the most exciting opportunity. Those who fall into the low engagement category but have high capacity and affinity offer the greatest potential for new and increased major gifts. These individuals may be known to development staff members, but their capacity may not. Therefore, they should receive the attention of the major gifts team for discovery and cultivation. Those who have high affinity but low capacity are likely to fall into the category of annual fund donors. These individuals may also be some of your most dedicated volunteers. Portfolio assignments, which can be one of a development leader’s most arduous and time-consuming tasks, can become a streamlined, highly-informed process based on the factual, data-driven information provided by wealth screening.

3. Identify Planned Giving and Board Prospects

As development teams build donor prospect portfolios for the staff and board, identifying planned giving and new board prospects is often overlooked in favor of the more immediate returns of individual donor solicitation. In the absence of an established planned giving program or an objective way to assess a board prospect’s financial capacity, investing in wealth screening is the perfect opportunity to lay the groundwork for this important source of long-term support. Many wealth screening programs incorporate predictive modeling to identify planned giving prospects. When combined with capacity, affinity, and propensity, a lengthy giving relationship with the organization, and factors such as age and documented membership in other legacy societies, wealth screening can support and validate the time and attention required to establish or nurture this important future-focused development program, as well as identify prospective board members who have a connection, commitment, and capacity to support an organization.

4. Support New Leadership

While a tenured development professional will know their primary donors’ capacity and affinity, an incoming development or executive leader tasked with rebuilding the development team or organization likely does not have the institutional knowledge to confidently identify those donors. Wealth screening is a strong investment in the success of a newly appointed development or executive leader. With fresh eyes, an incoming leader can both confirm well-known donors and identify donor prospects who may be unknown to the organization or not giving at their full potential. In addition, there may be new fundraising leads due to audience engagement with digital programming during the pandemic. The data provided through wealth screening allows an incoming leader to reaffirm those closest to the organization and identify lesser-known prospects with giving potential, parlaying their new leadership role into an opportunity to connect with these individuals. Imagine the board meeting several months later where the development or organizational leader announces the uptick in new relationships and gifts since their arrival. These early wins can inspire organizational momentum and build the board’s confidence.

5. Overcome Fundraising Obstacles

Boards of directors are often an organization’s greatest community ambassador and institutional asset. However, fundraising is often an underperforming area in a nonprofit organization and the one in which many board members feel least confident. As a result, board members can be resistant to the solicitation process, citing fear of rejection, a need for more training, and sometimes an uncomfortable lack of trust in staff knowledge or experience. Presenting wealth screening data can be the catalyst that helps board members cross over from fear and uncertainty into greater confidence in solicitation. This process can prepare board members (and executive and development leadership) for success and remove some of the obstacles to the solicitation process by using data to support cultivation or solicitation strategy. Additionally, many wealth screening analytics allow for a secondary affinity screening. For instance, while focused on an affinity for arts and culture, a development officer may also identify which donors have political affiliations or an affinity for educational institutions or social justice causes. Presenting this segmented data can help overcome objections to establishing or building program funding by demonstrating how various donor segments of the organization have an affinity for these areas. An added benefit is the opportunity to test the theory by exploring a prospect’s secondary affinity, which can leverage additional program support and build connection with current and prospective donors.

6. Motivate the Board Development Committee and Staff

A final important use of wealth screening addresses board and staff learning, as well as professional development opportunities. For example, for those interested in mentoring less experienced development team members, wealth screening is a real life, high-value lesson in the development science of donor research. The use of wealth screening data for donor prospecting, portfolio management, and the cultivation, solicitation, and stewardship cycle builds comprehension and professional growth for less experienced team members. For these individuals, there may also be an opportunity to co-manage certain portfolios for specific purposes, such as increased cultivation with a goal to move the donor up the annual fund giving ladder. For new teams or teams where opportunities for promotion may manifest less often, this is an opportunity to invest in staff, teach a new marketable skill, and provide a more data-focused approach to donor management. For board members, this step builds confidence and motivates them to more deeply engage in the donor cultivation process. All these elements can result in a stronger board and staff that is not only armed with greater knowledge and clarity of purpose, but also operates with a deeper understanding of the development process and their donor prospects.

Conclusion

As time and resources are a precious commodity, relatively low-cost wealth screening tools create more space for key development engagement strategies, such as fostering individual relationships, activating a donor’s passion for a cause, or showing the impact of philanthropic investment. Wealth screening brings data into the fundraising equation, creates more factual decision making, and builds greater confidence in the prospecting and solicitation process. When coupled with building the confidence and professional skill set of the development team, executive team, and board of directors, wealth screening delivers a swift and strong return on the investment. Finally, periodically refreshing the wealth screening of an organization’s individual donor base also makes sense in a post-pandemic environment when there has been significant economic change, physical relocations, stock portfolio adjustments, and other factors at play. By establishing an up-to-date and data-driven profile of the donor community, development professionals will be able to expand their focus and increase their time doing what they do best—building relationships and philanthropic investment.

[1] “Charitable Giving Statistics,” National Philanthropic Trust, https://www.nptrust.org/philanthropic-resources/charitable-giving-statistics/.

[2] Andy Ware, “The outlook for charitable giving,” IUPUI Lilly Family School of Philanthropy, https://blog.philanthropy.iupui.edu/2021/02/19/the-outlook-for-charitable-giving/.

Shawn D. Ingram, Vice President

Shawn D. Ingram, Vice President

Shawn D. Ingram is a revenue enhancement expert with more than 25 years of professional experience in nonprofit fundraising and management in the arts and social services. Joining ACG in 2015, Mr. Ingram serves on the firm’s Contributed Revenue Enhancement team, supporting a comprehensive international roster of clients with strategic fundraising and interim management solutions. His additional areas of expertise include capital campaign management, donor prospecting, major donor strategy, executive search, and organizational assessment. Mr. Ingram guided Cincinnati Playhouse in the Park through a comprehensive campaign planning and feasibility study, which culminated in his counsel on its $47.5 million integrated capital campaign. As an integral part of ACG’s interim management practice, he has served as Interim Director of Development at Laguna Playhouse, Interim Chief Advancement Officer at Arizona Broadway Theatre, and Interim Executive Director at Los Angeles Children’s Chorus. Prior to joining ACG, Mr. Ingram held positions as Executive Director at My Friend’s Place, Director of Development at the San Diego LGBT Community Center, Director of Development at The Trevor Project, and Director of Corporate and Foundation Development at La Jolla Playhouse. A current member of the DEI Alumni Council for the Berkshire School, Mr. Ingram has previously served as an Advisor to the San Francisco-based EACH Foundation and served on the board of directors for Creative Response of the Arts and Divisionary Theater in San Diego. He has performed extensively across the country as a professional singer and dancer and holds a bachelor of science in communication from Boston University.

Contact ACG for more information on how we can help your organization better understand the

fundraising potential of your donors, stakeholders, staff, and board.

(888) 234.4236

info@ArtsConsulting.com

ArtsConsulting.com

Click here for the downloadable PDF.