Investing in the Arts and

Future of Our Communities

Editor’s Note: Based on the following research conducted by National Assembly of State Arts Agencies (NASAA) released in February 2017, and in support of Arts Advocacy Day on March 20 and 21, 2017, Arts Consulting Group (ACG) is pleased to share NASAA’s findings on increased state arts appropriations. ACG recognizes that national, state, and federal investments in the arts generate significant social, economic, cultural, educational, and community returns. We thank NASAA for granting permission to republish its findings and congratulate the NASAA Board and staff for its tremendous service to the arts and culture sector.

State Arts Appropriations Increase in Fiscal Year 2017

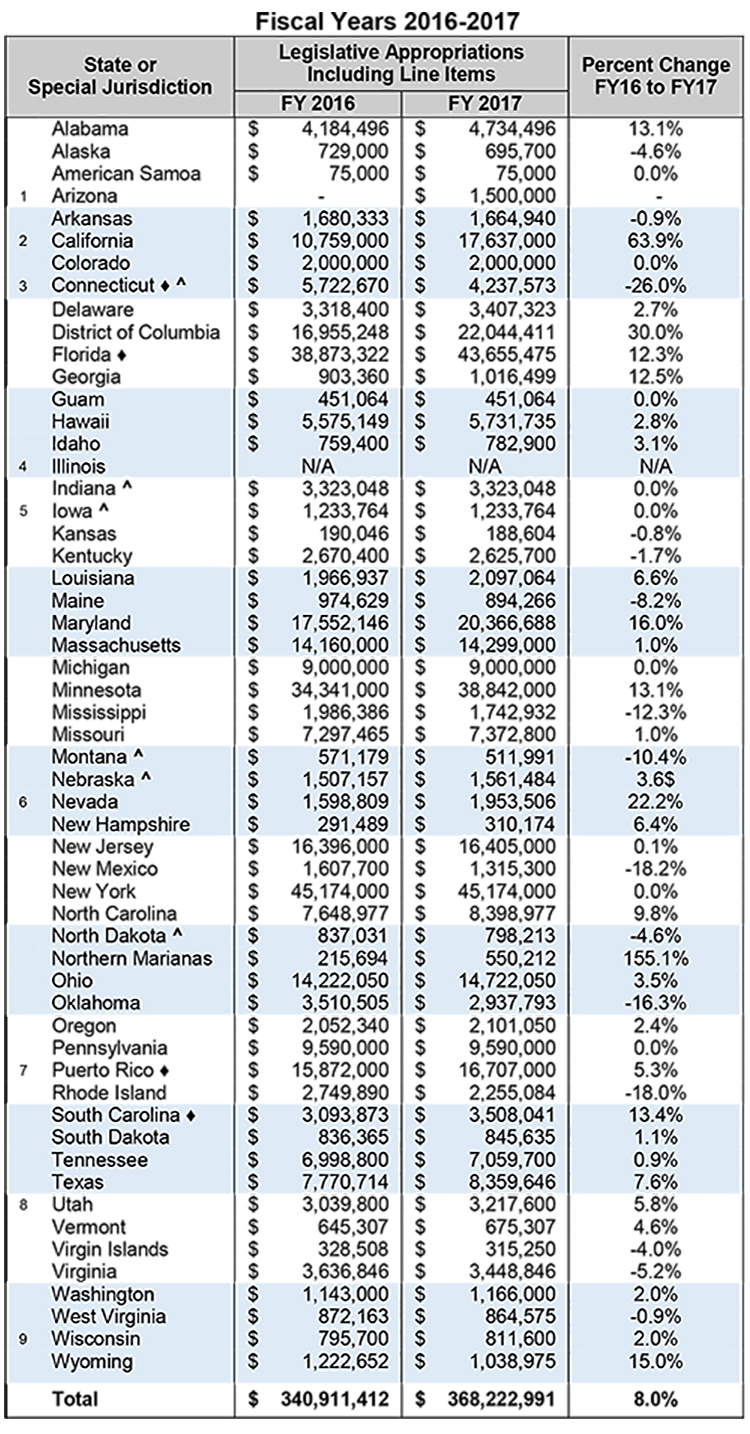

Legislative appropriations to state arts agencies increased by 8.0% in fiscal year 2017, according to the State Arts Agency Revenues report, published by the National Assembly of State Arts Agencies (NASAA).

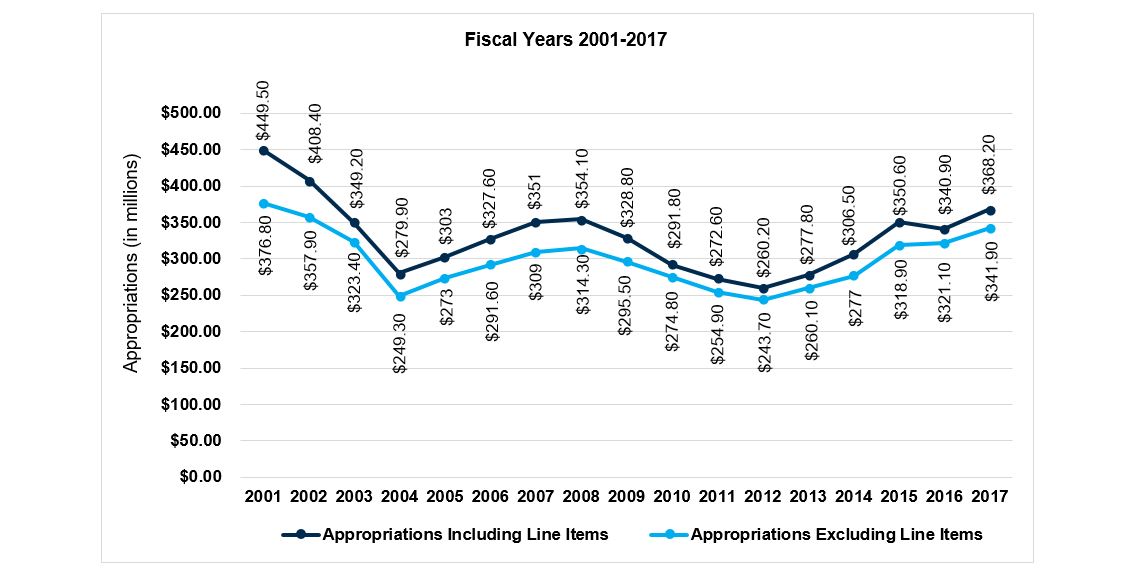

After a small decrease in state arts agency appropriations last year, FY2017 continues a trend of post-recession growth. State arts agency appropriations experienced a 20-year low of $260.2 million in FY2012. Between FY2012 and FY2017 these agencies gained $108 million. For FY2017, state legislative appropriations total $368.2 million, equating to an investment of $1.13 per capita. This is the third year in a row that state arts agency legislative appropriations have been above $1.00 per capita.

"State arts agencies address critical needs for American communities," said NASAA CEO Pam Breaux. "They utilize the creative power of the arts to strengthen the economy, rural development and education. They help preserve American culture, heritage and traditional practices. They support our military service members and help heal our veterans. State investments in the arts help leverage an additional $11 billion in local and private support for these causes. You would be hard-pressed to find a better return on investment."

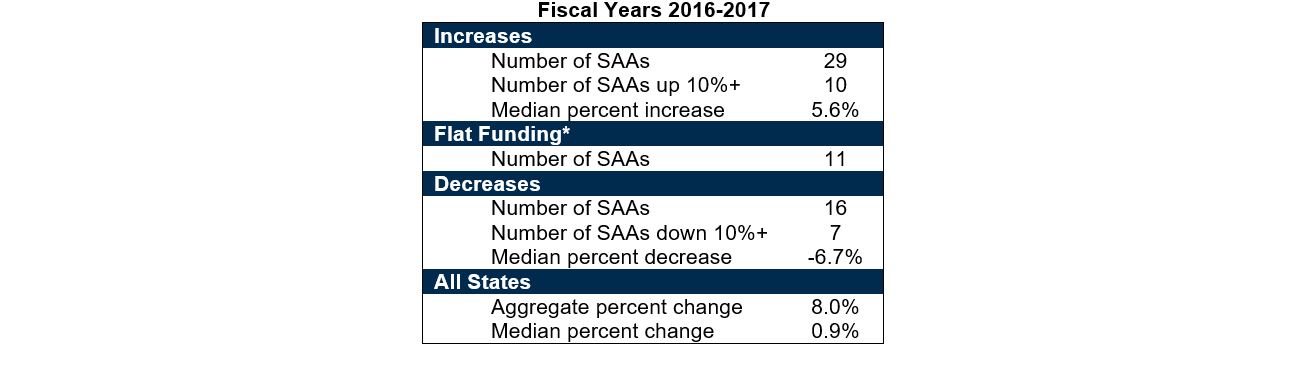

Although aggregate arts appropriations increased, there were notable variations among states. Twenty-nine state arts agencies reported increases in 2017, but most of that growth was concentrated in just 10 states. Sixteen state arts agencies reported decreases. Eleven state arts agencies reported flat funding. When line item appropriations (funds that pass through state arts agency budgets) are excluded, appropriations to state arts agencies increased by 6.5%.

State budgets are in a better position now than they were after the recession, though the long-term picture remains unsettled. State revenues remain below historical averages. The costs of health care, pensions, education and infrastructure maintenance continue to outpace modest revenue growth, continuing state budget challenges for the foreseeable future. Furthermore, federal funding in areas such as Medicaid, education, transportation and housing (all of which can significantly affect state revenues) are difficult to forecast.

The National Assembly of State Arts Agencies is the membership organization of the nation's state and jurisdictional arts agencies. NASAA serves as a clearinghouse for data and research about public funding and the arts. Additional information on state arts agency funding and the impact of government support for the arts is available on the NASAA website.

- Appropriations to state arts agencies comprise 0.041% (less than one-half of one-tenth of one percent) of total state general fund expenditures in FY2017.

- States currently invest $368 million – about $1.13 per capita – in state arts agencies.

- State arts agencies use legislative appropriations to make nearly 21,000 grant awards to organizations, schools and artists.

- Public policy goals addressed by state arts agencies include serving military families, economic development, rural sustainability, and educational excellence.

State Arts Agency (SAA) Total Legislative Appropriations Changes

Source: National Assembly of State Arts Agencies, State Arts Agency Revenues, Fiscal Year 2017

State Arts Agency Legislative Appropriations

Note: Line items are legislative appropriations not controlled by state arts agencies but rather passed through state arts agency budgets to other designated entities.

Source: National Assembly of State Arts Agencies, State Arts Agency Revenues, Fiscal Year 2017

Table 1: State Arts Agency Total Legislative Appropriations

Table Notes

? Percent change is significantly affected by a change in line items.

^ Figure reflects state arts agency (SAA) appropriation only and does not include appropriation to the state's cultural endowment.

1. Arizona: Since FY2012, the legislature has not appropriated funding to the SAA from the general fund. The SAA's FY2017 base appropriations were drawn from interest on the state's rainy-day fund and were nonrecurring. Other state funds are generated from state business license revenues.

2. California: One-time discretionary funds designated by the state legislature account for $6.8 million of the FY2017 appropriation. Other state funding includes support for the Arts in Corrections program.

3. Connecticut: The total appropriation for FY2017 does not include funding going through the agency's budget for line items to non-arts organizations.

4. Illinois: The state of Illinois has operated without a full and permanent budget since July 1, 2015.

5. Iowa: The Iowa Department of Cultural Affairs has sustained a mid-year de-appropriation for FY2017 of $210,958 as well as the complete elimination of the $6.1 million Iowa Cultural Trust as a result of efforts by the Iowa Legislature and Governor to address a projected state budget shortfall. The immediate impact on the Iowa Arts Council operating budget of approximately $41,000 is not captured in this report.

6. Nevada: Fiscal year 2017 appropriations include nonrecurring funds from the Department of Tourism and Cultural Affairs of $267,254.

7. Puerto Rico: Fiscal year 2017 figures were taken from the appropriated budget documented by Puerto Rico's Office of Management and Budget. The commonwealth's budget remains in distress due to uncertainty about long-term debt.

8. Utah: The agency's appropriation does not include state support for the Fine Arts Outreach POPS program and the Beverley Taylor Sorenson Arts Learning Program, which are administered by agencies other than the SAA.

9. Wisconsin: State funds listed in FY2017 assume match to the NEA. The SAA must obtain legislative action and the governor's signature for an additional $29,700, which is the difference between NEA funds and the amount allocated in the state's biennial budget.

Contact ACG for more information on how we can help you revitalize government, foundation,

corporate, and individual investments in your organization and community.

(888) 234.4236

info@ArtsConsulting.com

ArtsConsulting.com

Click here for the downloadable PDF.